GST increase Singapore 2022

Kick-start International Energy Week by joining us for the SP Global Platts London Energy Forum 2022. Getting the details right in 2022 will be no easier.

Platform Operators Gst Hst Changes On July 1 2021 Kpmg Canada

S5 per kg per day.

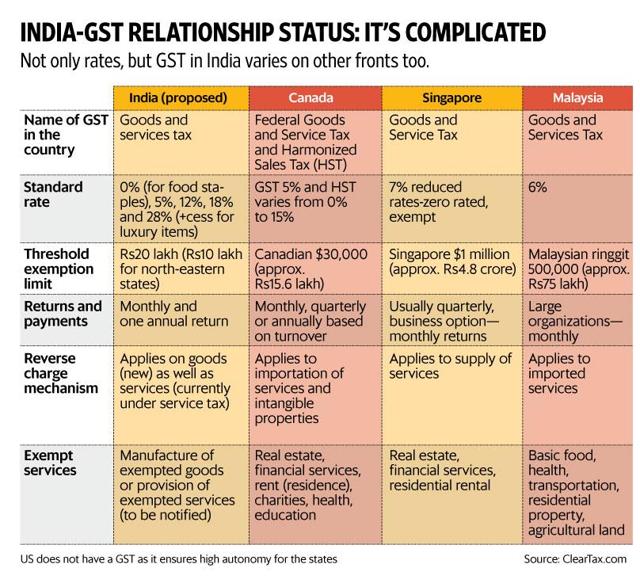

. What trends will persist in 2022. Government Social Safety Net. Canada has a dual model like in India the State GST and Central GST.

On 16 February 2021 Budget Day Finance Minister Heng Swee Keat announced that GST will be. While the exact time of the hike is uncertain the economic recovery and falling unemployment rate present a great opportunity for a GST hike to be introduced in the Budget 2022. GST is charged at 7 on the supply of goods and services made in Singapore by a taxable person in the course or furtherance of ones business and the importation of goods into Singapore.

SINGAPORE The electricity tariff for the first quarter of 2022 will increase by an average of 56 per cent for households in Singapore compared with the previous quarter due to higher fuel costs SP Group said on Thursday 30 December. It is a comprehensive tax subsuming. Here are the details for NUS MBA Fees for the academic session 2021-2022.

Key Updates on GST. In the 2021 Budget the specific date for the GST rate. On this the analysts say they are positive on the outlook for Singapore and Thailand with both countries likely to outperform in 2022 due to accelerating growth on the reopening of borders.

Sources International Energy Forum commends India on. The Inland Revenue Authority of Singapore IRAS will be revising the Annual Values AVs of HDB flats upwards by 4 to 6 with effect from 1 January 2022 in line with the increase in market rentals. GST increase to 7 On 15.

Gold bars must be collected in person at UOB Main Branch within 5. Higher carbon prices and environmental taxes increase production costs for industrials while under-investment in fossil fuels has contributed to a spike in energy costs that threatens to dampen growth and disrupt output. Park Plaza Westminster Bridge Hotel London Online.

Changed tax rates will come into effect from January 1 2022. The revision by 133 cents per kWh on average for 1 January. The AV revision is part of IRAS annual review of properties to compute the property tax payable.

The rate will be. There will be live television and radio coverage of the Budget Statement and a live webcast of its delivery will be available on the Singapore Budget websiteIt will also be published on the website after delivery. SGD 68000 exclusive of GST payable over 2 semesters.

GST collections record the second highest monthly mop up in. Exempttax-free items Its also worth noting that some goods which are exempt from VAT may not be exempt from GST and vice. To stay ahead of.

This applies only where the business or part of. NUS MBA Fees 2021-2022. SGD 68000 exclusive of GST payable over 4 semesters.

3929 The future of employment and the Singapore job market. On top of these abovementioned areas we should expect to incur higher expenses not only due to inflation but also because of the planned increase in Goods and Services Tax GST. S2 per piece per day for small bars Note.

It was announced in the 2018 Budget that this rate would be increased to 9 sometime between 2021 and 2025. Excluding Goods and Services Tax GST the tariff for households will go up from 2411 cents to 2544 cents per kWh for the quarter ending Mar. SDMIMD Mysore PGDM Admission 2022.

IMT Common Admissions 2022 Know More. Join the Online GST Certification Course at IIM SKILLS today for a lucrative career. Exporters who have received capital goods under the EPCG scheme are allowed to claim the refund of the IGST paid on exports.

TCS to be collected at the rate of o5 under CGST Act on the value of net taxable. 2100 Helping your fellow Singaporean. Thereafter many European countries introduced it in 1970-80s.

GST To Increase After 2022. Whereas the rate of VAT in the UK is 20 the rate of GST in Australia Singapore and Canada is 10 7 and 5 respectively. The decision is.

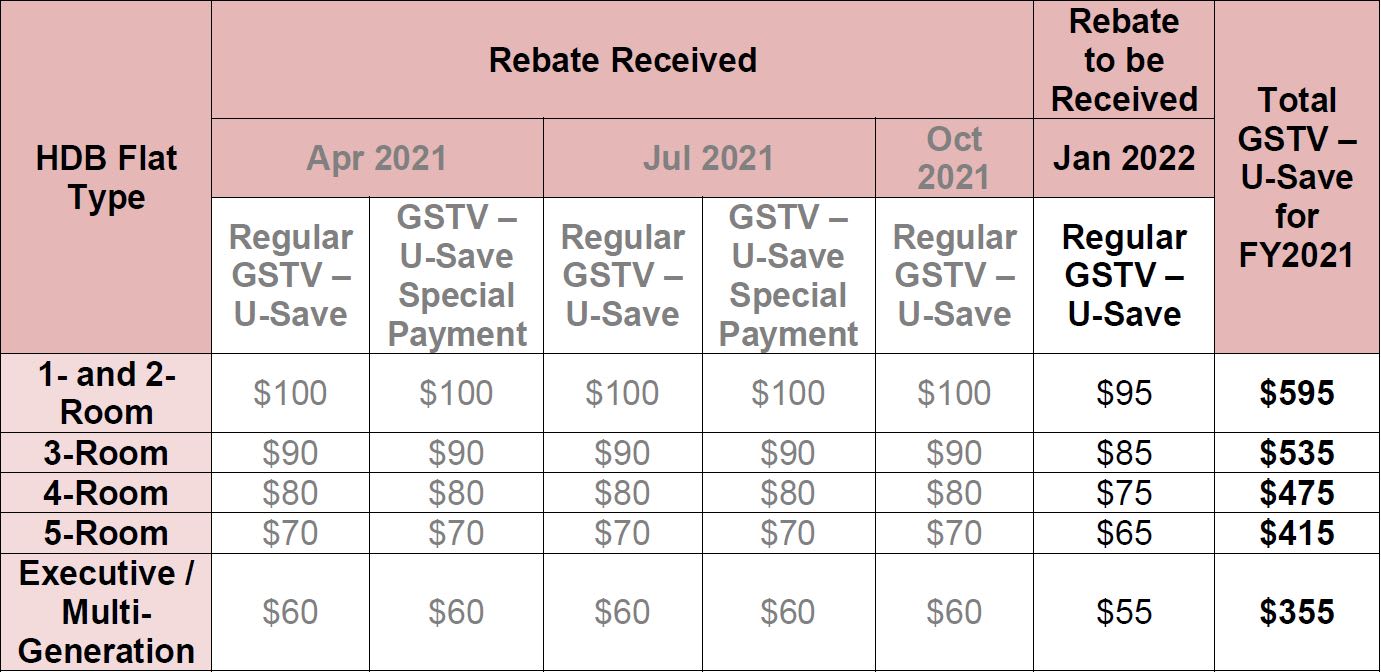

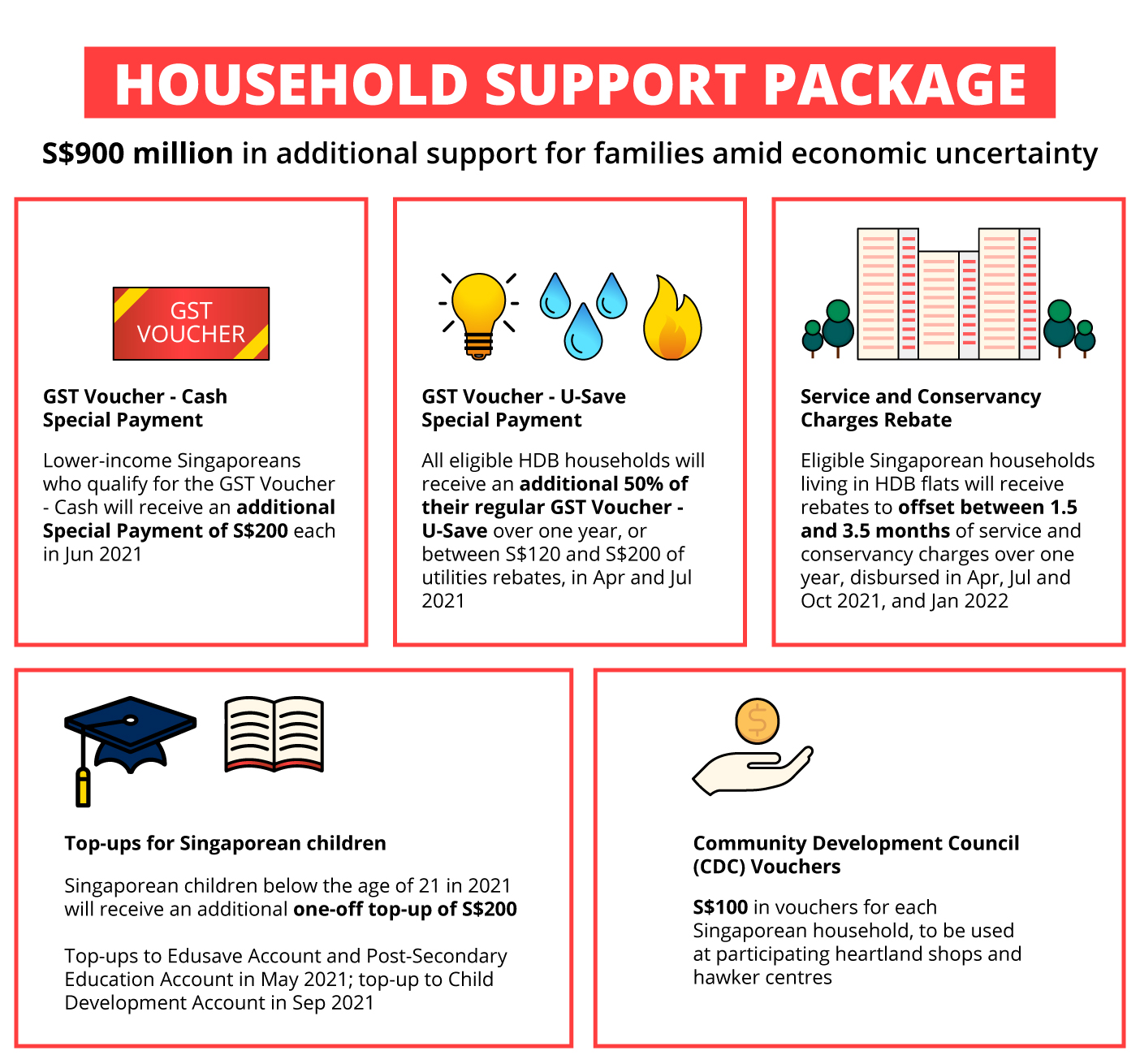

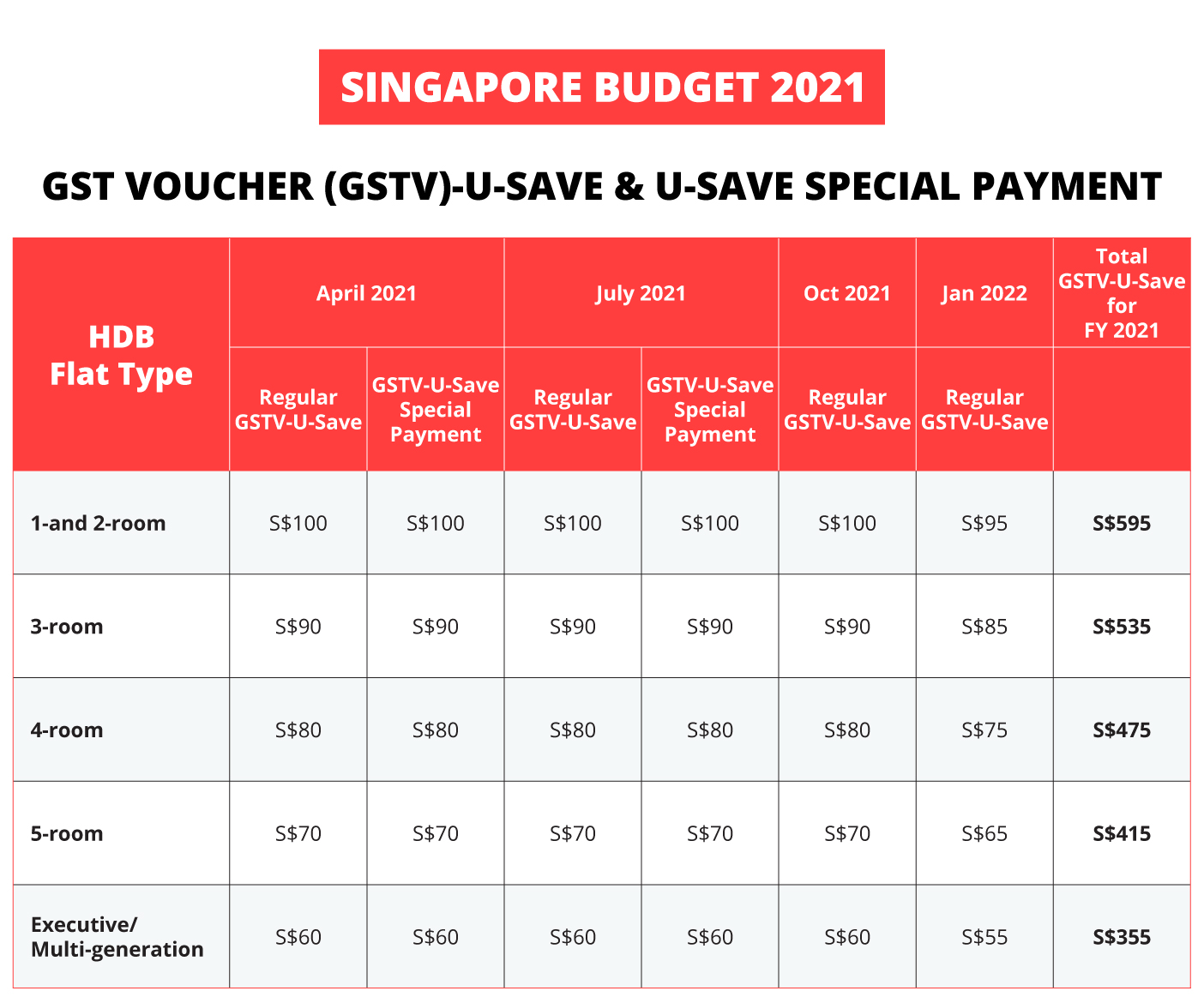

February 21 2022 830 am - 400 pm GMT. In view of uncertainty due to the COVID-19 pandemic the GST increase will be deferred to after year 2022 with a S6 billion Assurance Package proposed in 2020 to cushion the impact when the hike kicks in. This Statement sets out the STAs standards and expectations of everyone involved in its activities.

The above fee applies to Singapore Citizens Singapore Permanent Residents and International Students. 3 Dec 2021. First announced in the Budget 2018 GST is expected to increase from 7 to 9 from 2022 to 2025.

Prior to the change in tax structure the GST on MMF MMF yarn and MMF fabrics were 18 12 and 5 respectively. S30 subject to GST if you close the account within six months from account opening date. Gold bars Late collection charge.

Japan 1989 Malaysia 2015 Australia 2000 Singapore 1994 and Canada 1991 already have the GST in place. Adding gold to your portfolio is one way to increase diversification. Forex reserves increase 19 billion to 642 billion Govt to use revenue surge to fund welfare drives not beat fiscal deficit target.

4225 What will 2022 be like for you. Early account closure fee. 2500 Elderly who cant afford to retire.

SINGAPORE Finance Minister Lawrence Wong will deliver Singapores FY2022 Budget Statement on Friday 18 February 2022 in Parliament. They have also pegged Singapores benchmark Straits Times Index STI at a year-end target of 3550 points for the FY2022. SINGAPORE - The plan to raise the goods and services tax GST between next year and 2025 remains unchanged Finance Minister Lawrence Wong.

While Singaporeans were assured in Budget 2021. 3130 The new norm. Another motivating factor for the government would be the fact that delaying this unpopular legislation much longer would bring it dangerously close to the impending Presidential.

Rate of taxation When it comes to GST vs VAT tax VAT is typically higher than GST. The Singapore Tennis Association STA is committed to providing a safe diverse and equitable environment to all members of the tennis community in Singapore. The standard rate is currently 7 percent but is expected to increase to 9 percent between 2022 and 2025.

The Goods and Services Tax GST implemented on July 12017 is regarded as a major taxation reform till date implemented in India since independence in 1947. In November 2021 the GST had increased to Rs152 crore. This ensures that everyone at all levels of the sport continues to have a positive experience in tennis.

The transfer of a business or a part of the business that is capable of separate operation as a going concern is treated as neither a supply of goods nor services for GST purposes on which GST is not chargeable. 31 2022 before factoring in Goods and Services Tax GST. SOIL Gurgaon PGPM PGDM Admission 2022.

The tariff for households will go up from 2411 cents to 2544 cents per kWh for the quarter ending Mar. The Ministry of Finance had released a statement saying that the GST revenue for Meghalaya in November last year was Rs120 crore. GST on imported low-value goods.

Meghalaya had seen an increase in its Goods and Services Tax GST revenue by 27 in November 2021. London Energy Forum 2022. From the US to India -- collectively committed this year.

Changes In Gst Rates On Services W E F October 1 2021 A2z Taxcorp Llp

Gst Singapore A Complete Guide For Business Owners

Budget 2021 More Help For Pandemic Hit Singaporeans Dbs Singapore

India Number Of Gst Taxpayers In India 2020 By State Statista

Gst Singapore A Complete Guide For Business Owners

What India Can Learn From Failure Of Malaysia S Gst

How India S Gst In Its Current Avatar Deviates From Global Practices Hindustan Times

Budget 2021 More Help For Pandemic Hit Singaporeans Dbs Singapore

Retail 16000 Fire Sale 10000 Wire New Rolex Black Dial 31mm Oyster Perpetual Date Just With Yellow Gold And Diamonds Come Rolex New Rolex Oyster Perpetual

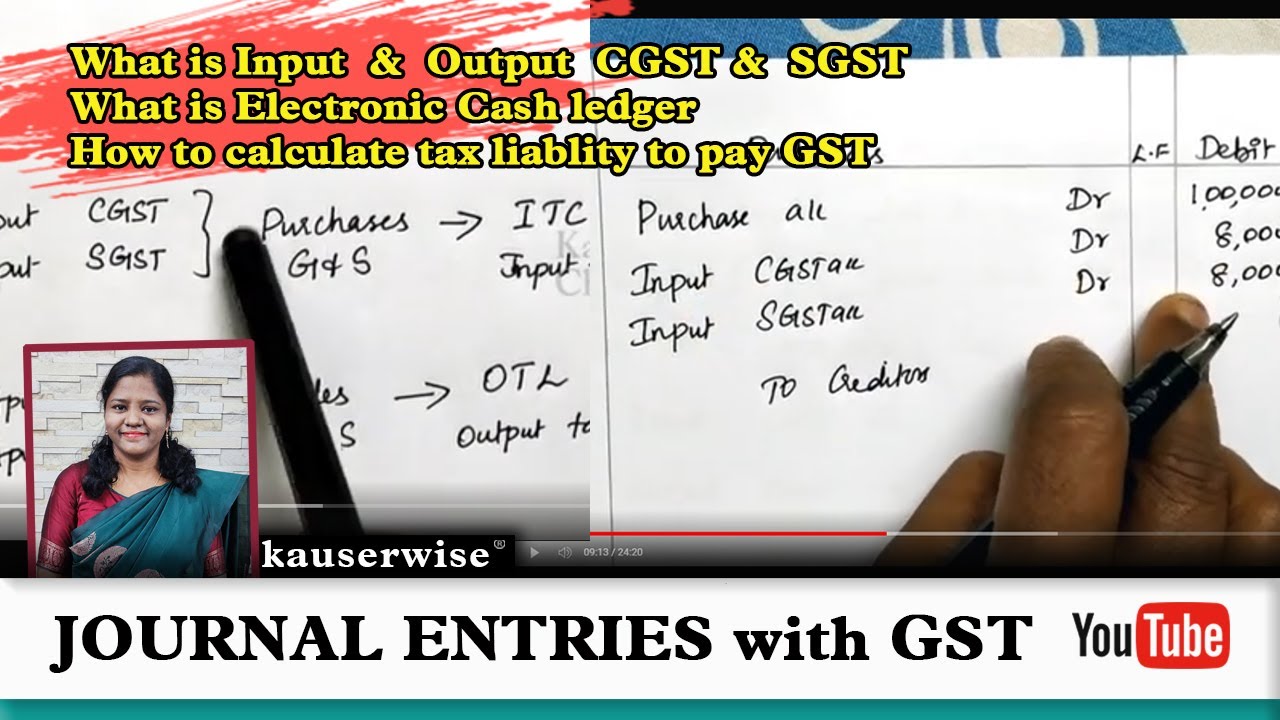

How To Make Journal Entries With Gst What Is Input Output Cgst Sgst Finding Tax Liability Youtube

The Gst Tax Rate Structure In India Download Table

Singapore Gst Treatment For Transactions Involving Digital Payment Tokens Bdo

Corporate Travel Corporate Travel Booking Hotel Vacation Packages

Average Prices For Aluminum Worldwide From 2014 To 2025 Statista

46th Gst Council Meet On Dec 31 To Discuss Rate Rationalisation The Economic Times